How Self-Funded Medical Plans Work

-A solution to lowering employee benefits costs

A real case example and strategy from an insurance broker’s perspective.

How A Self-Funded Medical Plan Can Reduce The Cost of Employee Benefits

If you are the lucky person in charge of finding a solution to reducing the cost of employee benefits for your company, I have good news for you, you have found the solution, self-funded medical plans.

Below is a real case example of how a transportation company in Houston managed to reduce healthcare costs using a self-funded plan.

This real-life case may help you understand how self-funded medical plans work and determine if implementing this type of plan for your company would make sense in meeting goals to lower the cost of your employee benefits.

A self-funded or level-funded medical plan can reduce your monthly group medical premiums, depending on the demographics of your group. It offers the same benefits as a fully insured plan. By using a different risk structure this option may translate to cost-savings every month.

This health insurance cost reduction strategy works by restructuring the risk on the medical claims. In essence, based on your employee census, the insurance carrier creates a customized cost structure where the employer pays for up to a specific amount in claims, called an Attachment Point.

If medical claims exceed the attachment point, a stop-loss coverage is triggered and pays for anything above the amount of the claims threshold.

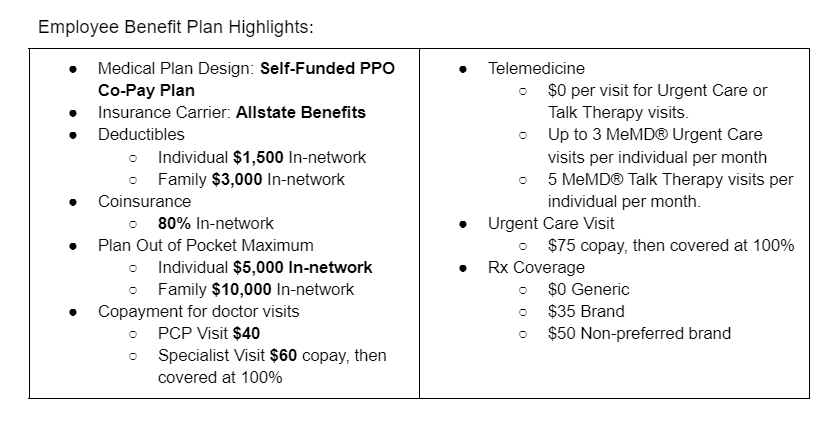

The self-funded medical plan below was implemented in September of 2022 for a 26-employee warehouse and transportation office in Houston. The “Employee-only” premium for this Houston business is $598.32, of which the employer must pay at least 50%.

Let’s Get In Touch!

Let Us Assist You

Speak To A Licensed Broker

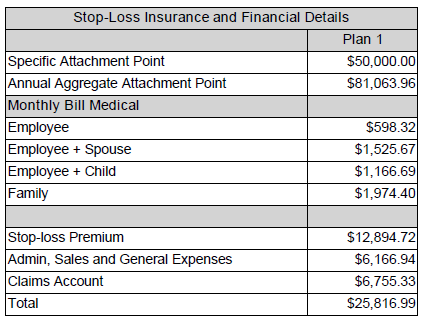

The monthly premiums the insurance company receives are divided to pay for different parts of the plan. Below is the breakdown of the cost for this group of 26 employees.

The monthly premium is $25,816.99. Of this amount, $6,755.33 goes towards the Claims Account, with an Annual Aggregate Attachment Point of $81,603.96 reserved to pay claims.

- If claims do not reach the Annual Aggregate Attachment Point amount, the employer receives a refund of 50% of the unspent amount, which can be used for next year’s premium.

- If the claims exceed the Annual Aggregate Attachment Point amount, then the stop-loss protection is triggered, and the employer is not responsible for any claims above $81,063.96 (Annual Aggregate Attachment Point)

The Stop-loss Premium is $12,894.72. The remaining amount, $6,166.94 is administrative costs, including a TPA (Third Party Administrator) who processes claims and manages the plan.

As shown above, The “Employee-only” premium for this Houston case is $598.32, of which the employer must pay at least 50%, in order to be compliant with the Affordable Care Act. Other enrollment options include:

- The “Employee + Spouse” premium is $1,525.67, of which the employer may elect to contribute a percentage from 0 to 100%.

- The same applies to “Employee + Children” $1,166.69 and “Employee + Family”, $1,974.40.

A self-funded plan is the most realistic way of saving on employee benefits, provided your group is healthy enough and young enough.

To find out if reducing employee benefits costs is possible through a self-funded plan, you can request a proposal based on an employee census, by following these steps:

- Request an employee census form to complete so we can provide you with a quote. Use the button above/below, or click here.

- Next, you receive a preliminary proposal that will allow you to compare self-funded vs fully insured costs based on actual data.

- If the quote shows using a self-funded plan will lower employee benefits costs, then we invite each employee to complete an online application.

- Once all employees complete the online application we send a firm rate proposal.

- The plan is implemented with an effective date no more than 60 days in the future.

It is very likely you no longer need to continue to pay high premiums for your fully insured plan. If you decide to explore a self-funded medical plan, we can design an offering that incorporates your specific criteria to meet your coverage needs, employee benefits cost reduction goals.

Thank you for the opportunity to earn your business!

Let's Get In Touch

Let Us Assist You

Speak To A Licensed Broker

Why Nolasko

We are independent. That means you save. Our commitment is to you, not the insurance carriers.

- We specialize in commercial insurance

- Savings on annual premium -Independent broker-agency

- Same day coverage for most lines of coverage. Quick turnaround for more complex cases

- Professional and dedicated service